Forex trading, or foreign exchange trading, involves the buying and selling of currencies on the foreign exchange market with the goal of profiting from currency fluctuations. For beginners, it’s essential to start with a solid understanding of basic concepts and strategies to manage risk effectively. Here are some forex trading strategies suitable for beginners:

1. Understanding the Basics

- Learn the Market: Understand how the forex market operates, including currency pairs, trading hours, and market participants.

- Risk Management: Implement risk management techniques such as setting stop-loss orders to limit potential losses and defining a risk-reward ratio for each trade.

- Demo Trading: Practice with a demo trading account to gain practical experience without risking real money. This allows you to test strategies and familiarize yourself with trading platforms.

2. Trend Following Strategy

- Identify Trends: Use technical analysis tools like moving averages or trendlines to identify trends in currency pairs.

- Follow the Trend: Enter trades in the direction of the trend (buying during uptrends and selling during downtrends). Avoid counter-trend trading as a beginner.

- Set Stop-Loss: Place stop-loss orders below (for long positions) or above (for short positions) key support or resistance levels to protect against adverse price movements.

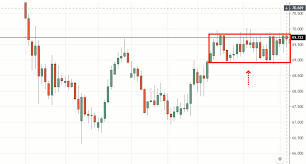

3. Breakout Strategy

- Identify Breakouts: Look for currency pairs that are trading within a narrow range or consolidation phase.

- Entry on Breakout: Enter trades when the price breaks above resistance levels (for long positions) or below support levels (for short positions).

- Confirm with Volume: Confirm breakout signals with increasing trading volume, indicating strong market participation.

4. Support and Resistance Strategy

- Identify Support and Resistance Levels: Use technical analysis to identify key support (price levels where buying interest is strong) and resistance (price levels where selling interest is strong) levels.

- Buy at Support, Sell at Resistance: Enter trades when the price bounces off support levels (for long positions) or reverses near resistance levels (for short positions).

- Combine with Other Indicators: Use indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) to confirm support or resistance levels.

5. Swing Trading Strategy

- Identify Swing Points: Look for currency pairs that exhibit short- to medium-term price swings within a trend.

- Enter on Pullbacks: Enter trades at retracement levels (e.g., Fibonacci retracement levels) during uptrends (for long positions) or downtrends (for short positions).

- Use Technical Indicators: Combine swing trading with technical indicators to time entries and exits, such as moving averages or Bollinger Bands.

Tips for Beginners:

- Start with Major Currency Pairs: Focus on major currency pairs (e.g., EUR/USD, USD/JPY) that have high liquidity and lower spreads.

- Stay Informed: Keep abreast of economic news and events that can impact currency markets (e.g., interest rate decisions, economic data releases).

- Avoid Overtrading: Stick to your trading plan and avoid emotional trading decisions. Trade only when there are clear signals and opportunities.

- Continuous Learning: Forex trading requires ongoing education and adaptation to market conditions. Stay updated with forex resources, books, and online courses.

Remember, forex trading involves risks, and it’s essential to start with small trades and gradually increase your position size as you gain experience and confidence. Practice discipline and patience in implementing trading strategies to improve your chances of success in the forex market as a beginner.